SAP Document & Reporting Compliance

Successfully implement the eInvoice requirement with SAP Document & Reporting Compliance.

General information on SAP Document & Reporting Compliance

With SAP Document & Reporting Compliance, legal requirements can be fulfilled worldwide. Whether using SAP ECC or SAP S/4HANA, SAP Document & Reporting Compliance helps you comply with global legal requirements for electronic invoices and other business documents. Within SAP ECC or SAP S/4HANA, the solution is based on the eDocument framework for creating and processing electronic documents.

Create and send eInvoices

eInvoices can be created from various SAP source documents, such as SAP SD, SAP FI, IS-U. For this purpose, the data of the processes in the Application Interface Framework (AIF) is mapped into the respective country-specific and process-specific XML target format. In the mapping, the XML can be enriched with further data and documents so that all requirements can be met.

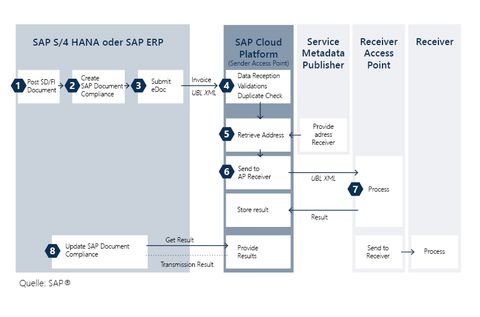

SAP Document & Reporting Compliance, invoicing option for PEPPOL

The SAP Document & Reporting Compliance, invoicing option for PEPPOL solution enables eInvoices to be transmitted to customers via PEPPOL. Hosted by SAP, the solution integrates with the leading SAP ERP or S/4HANA so that outgoing invoices are transmitted to the recipient access point via SAP's sender access point.

Fink IT-Solutions supports you from planning to implementation and operation of SAP Document & Reporting Compliance. Contact vertrieb@fink-its.de.

Our services

- Consulting and implementation of SAP Document & Reporting Compliance

- Support and Managed Services

- Training & Coaching

- Fulfill compliance requirements

- Fast implementation of document transfer via PEPPOL

- Directly integrated into SAP (modules SD and FI)

- Transmit eInvoices to various national and international portals

- Document Cockpit for monitoring the processes

- Use of the SAP Access Point

- One test and one production access

CONTACT US NOW!

We will be happy to help you personally.